AI Generated Summary

- The book was launched on Wednesday in the presence of senior public figures, diplomats and members of the Sikh community, reflecting the wide interest in a subject that bridges faith, finance and public service.

- A richly researched new book released in the national capital this week brings to light a lesser-known but deeply influential chapter of India’s financial history — the enduring role of Sikhs in shaping the country’s banking culture through ethics, service and institution-building.

- Founded in 1908 following deliberations at Sri Darbar Sahib and a resolution of the Chief Khalsa Diwan, the institution is portrayed as a landmark expression of Sikh economic self-reliance during colonial times.

A richly researched new book released in the national capital this week brings to light a lesser-known but deeply influential chapter of India’s financial history — the enduring role of Sikhs in shaping the country’s banking culture through ethics, service and institution-building.

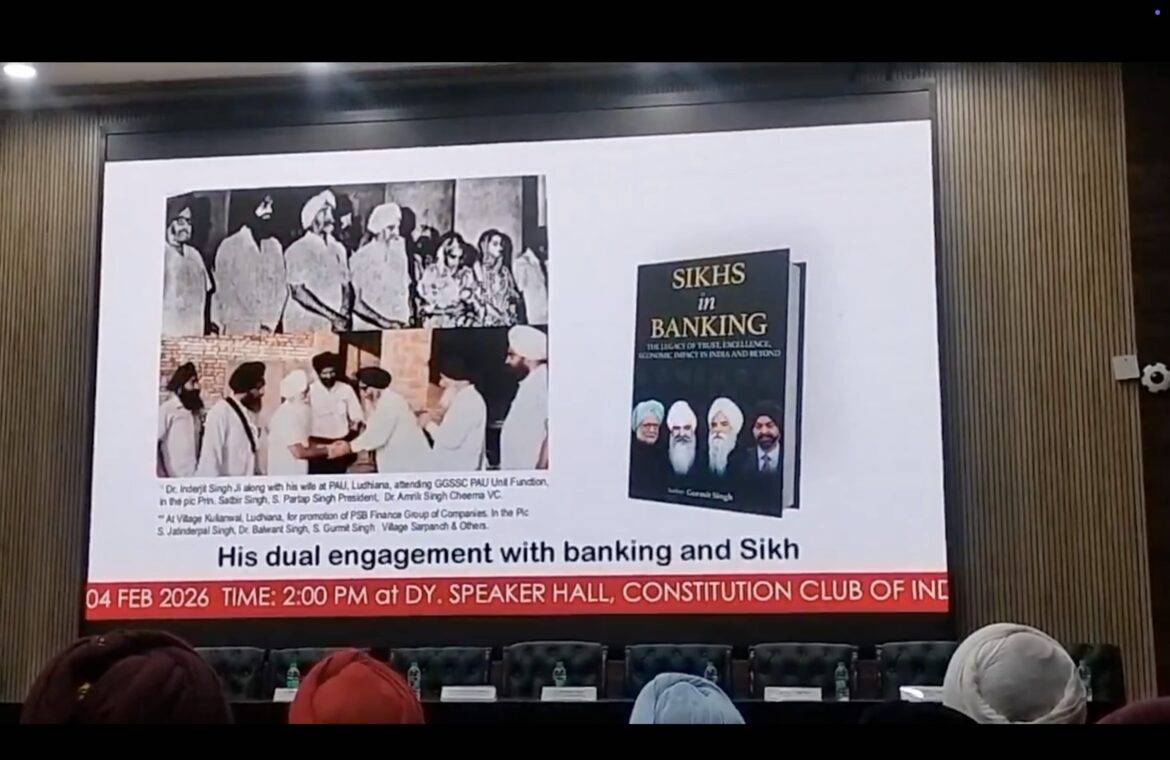

Authored by Gurmit Singh, a retired Chief Manager of Punjab & Sind Bank and a founding member of the Guru Gobind Singh Study Circle, the volume presents a sweeping account of Sikh engagement with banking in India and abroad. Titled Sikhs in Banking: The Legacy of Trust, Excellence and Economic Impact in India and Beyond, the 338-page illustrated work goes beyond conventional institutional history, offering what its author describes as a civilisational narrative that links spiritual philosophy with economic life.

The book was launched on Wednesday in the presence of senior public figures, diplomats and members of the Sikh community, reflecting the wide interest in a subject that bridges faith, finance and public service.

At its core, the work advances a compelling argument: that Sikh economic thought has always viewed wealth creation as inseparable from moral responsibility. Banking, in this framework, is not merely a commercial activity but a form of social enterprise. Drawing extensively from the Sri Guru Granth Sahib, the book highlights foundational Sikh principles such as Kirat Karni (earning through honest labour), Vand Chakna (sharing with others) and Sewa (selfless service) as ethical anchors for professional conduct.

The opening chapters explore how these values translated into practical governance in different historical periods. The author traces Sikh engagement with economic administration back to figures like Baba Banda Singh Bahadur and Maharaja Ranjit Singh, showing that structured revenue systems, fair taxation and disciplined financial management were integral to Sikh rule. References to Nanakshahi and Gobindshahi coinage underscore an early and sophisticated awareness of monetary sovereignty and economic organisation.

A substantial portion of the book is devoted to Punjab & Sind Bank, which the author describes as the “cradle of Sikh bankers”. Founded in 1908 following deliberations at Sri Darbar Sahib and a resolution of the Chief Khalsa Diwan, the institution is portrayed as a landmark expression of Sikh economic self-reliance during colonial times.

Through archival material and personal accounts, the book charts the bank’s journey from its pre-Independence roots to its role in post-Partition rehabilitation, nationwide expansion and eventual nationalisation. Special attention is given to the transformative leadership of Dr Inderjit Singh between 1960 and 1982, a period during which rural banking, financial inclusion and staff development were significantly strengthened. Under his stewardship, the bank sought to combine professional excellence with a strong sense of community purpose.

While celebrating these achievements, the author also turns a critical eye to the present landscape. He notes that after nationalisation, India no longer has a large independent Sikh-led bank and raises the question of whether a globally relevant, values-based Sikh financial institution is needed in today’s interconnected world.

Another notable feature of the book is a series of profiles of nearly 40 eminent Sikh bankers from India and overseas. These sketches highlight careers marked by integrity, innovation and public service, illustrating how individuals carried ethical commitments into leadership roles across diverse financial systems.

The concluding sections broaden the discussion beyond banking halls and boardrooms. They document Sikh bankers’ contributions to education, healthcare, disaster relief and gurdwara management, reinforcing the idea that professional success finds its highest meaning when paired with social responsibility. Reflections by scholars and practitioners on ethical banking and the future of value-driven finance add contemporary relevance to the historical narrative.

Dedicated to the 350th martyrdom anniversary of Guru Tegh Bahadur, the book positions itself as both tribute and testimony — a reminder that the Sikh tradition’s engagement with economics has always been rooted in courage, compassion and conscience.

In an era when public trust in financial institutions is frequently tested, the volume offers a timely reminder that banking, at its best, can be an instrument of social good. By weaving together history, biography and philosophy, Gurmit Singh’s work invites readers to reconsider the moral foundations of finance and the enduring power of values in shaping institutions.