AI Generated Summary

- In a bid to deeply comprehend the present and future terrain of digital payments, PhonePe Pulse has joined forces with the Boston Consulting Group (BCG) to unveil an exclusive report christened “Digital Payments in India.

- In an endeavor to decode the revelations encapsulated within the report and unravel the intricacies of the digital payments ecosystem, CNBC-TV18 orchestrated a panel discussion.

- Within the forum, the panelists engaged in a comprehensive exploration of the rapid embrace of digital currency, with a staggering 40% of payments transitioning towards non-cash modes.

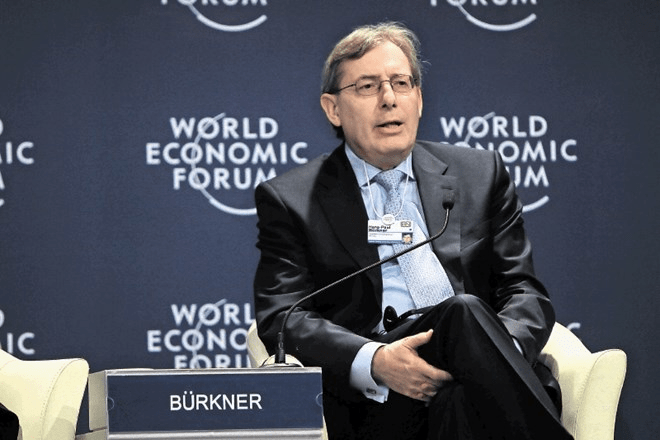

Renowned economist Hans-Paul Burkner, holding the esteemed position of Boston Consulting Group global chair emeritus, recently graced India with his presence at the Business 20 summit held in the nation’s capital. With a history of leadership as the chief executive officer and president of the group, Burkner’s insights hold weight, and his latest pronouncement resonates powerfully: India’s identity stands distinct, fortified by its autonomous stance and developmental prowess.

The digital payments sphere within India has undergone a remarkable metamorphosis over the last half-decade. Impressively, 2 out of every 5 transactions have embraced digital channels, bolstering a colossal US$3 trillion digital payment market. This surge portends a momentous stride towards realizing the vision of a cashless economy. Yet, amidst this exhilarating surge, particular segments within the market linger untapped, promising substantial growth potential. In a bid to deeply comprehend the present and future terrain of digital payments, PhonePe Pulse has joined forces with the Boston Consulting Group (BCG) to unveil an exclusive report christened “Digital Payments in India: A US$10Tn Opportunity.”

A product of PhonePe’s flagship initiative, Pulse, this resource has swiftly cemented its status as India’s definitive source for accurate, comprehensive insights into the nation’s digital payment trends. The report in question marks the second annual installment from PhonePe Pulse, unfurling a meticulous commentary on the digital payments ecosystem. It further navigates through the factors and catalysts primed to unlock the massive growth potential lying ahead. The report accentuates the transformative impact of emerging players, wielding diverse offerings that have galvanized the adoption of digital payments on a grand scale. The concerted efforts of both global and Indian fintech giants have effectively propelled the widespread acceptance of the Unified Payments Interface (UPI) amongst end-users. Notably, this is bolstered by an expansive QR-code based merchant network that spans across nearly 99% of India’s postal codes.

In an endeavor to decode the revelations encapsulated within the report and unravel the intricacies of the digital payments ecosystem, CNBC-TV18 orchestrated a panel discussion. Esteemed figures from the industry converged for this insightful dialogue, including Praveena Rai, Chief Operating Officer of the National Payments Corporation of India (NCPI); Karthik Raghupathy, Head of Strategy and Investor Relations at PhonePe; and Prateek Roongta, Managing Director and Partner at the Boston Consulting Group (BCG).

Within the forum, the panelists engaged in a comprehensive exploration of the rapid embrace of digital currency, with a staggering 40% of payments transitioning towards non-cash modes. Currently, the landscape of digital transactions is marked by a robust US$3 trillion, projected to burgeon threefold to an astounding US$10 trillion by the dawn of 2026. The panel acknowledged the Fintech ecosystem’s pivotal role in seamlessly onboarding merchants, capitalizing on tech-driven catalysts, and the proliferation of grassroots efforts, affectionately dubbed the “feet on the street” approach by Praveena. Furthermore, the discourse underscored India’s evolution from a service-oriented technology hub to a product-oriented one, evidenced by a surge in techpreneurs and tech visionaries harnessing a customer-centric approach.

In summation, the trajectory of India’s digital payments realm is poised for unprecedented growth, fueled by an amalgamation of strategic vision, technological prowess, and untapped potential.