AI Generated Summary

- In an era when governments are scrambling to crack down on illicit financial flows, Canada’s real estate market, particularly in Toronto, has unwittingly emerged as a magnet for laundered wealth.

- Far from the image of polite orderliness the country projects, its lax anti-money laundering (AML) enforcement has turned it into a critical node in the global chain of financial fraud and embezzlement.

- This includes rolling out a comprehensive national registry of beneficial landowners, enforcing AML standards in the real estate and mortgage sectors, and cracking down on the misuse of shell companies.

In an era when governments are scrambling to crack down on illicit financial flows, Canada’s real estate market, particularly in Toronto, has unwittingly emerged as a magnet for laundered wealth. Far from the image of polite orderliness the country projects, its lax anti-money laundering (AML) enforcement has turned it into a critical node in the global chain of financial fraud and embezzlement.

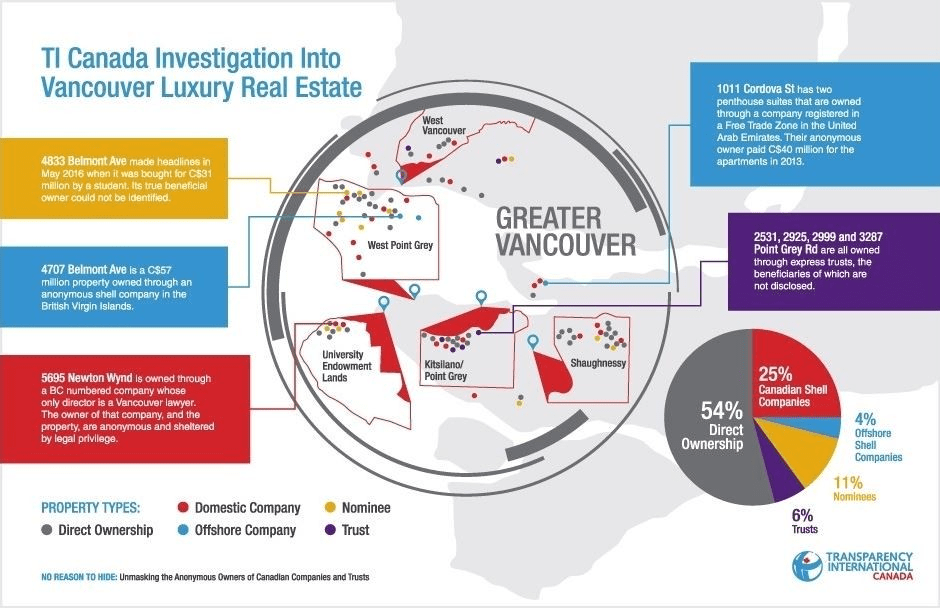

Between 2008 and 2018, over $28 billion was funneled into Toronto’s real estate market through corporate entities with questionable origins, $10 billion of which involved cash transactions that bypassed Canada’s AML systems. In 2023, more than half of the luxury homes valued at over $7 million were owned by anonymous corporations. These staggering figures expose the deep cracks in Canada’s financial regulatory framework, particularly in the real estate sector, which has become fertile ground for money laundering.

Begum Para: A Symbol of Wealth Migration

Take, for instance, the phenomenon of “Begum Para,” affluent neighborhoods in the Greater Toronto Area (GTA) named after the influx of Bangladeshi wealth. Members of Bangladesh’s elite have exploited Canada’s weak regulatory framework to channel their assets into high-end properties, shielding their identities through shell companies and trusts. With Canada marketing its permanent residency programs as investment-friendly, and a Bangladeshi immigrant community numbering 500,000, the GTA has become a nexus of wealth migration.

While British Columbia introduced a Landowner Transparency Registry in 2020 to address similar issues, Ontario and Canada’s federal government have been slow to act. A proposed national database of beneficial landowners, set for 2025, feels like too little, too late.

Systemic Weaknesses and Global Implications

Canada’s role as a full member of the Financial Action Task Force (FATF) should theoretically put it at the forefront of combating money laundering. Yet, FATF’s 2016 Mutual Evaluation Report highlighted vulnerabilities stemming from Canada’s open economy and accessible financial systems. An internal report by Canada’s Financial Intelligence Unit in 2022-2023 found that 61 of 71 surveyed real estate firms lacked robust AML policies, and nearly half failed to meet basic client identification requirements.

The problem extends beyond real estate. Unregulated mortgage lenders manage an estimated $35 billion in residential loans in the GTA, providing further opportunities for illicit funds to integrate seamlessly into Canada’s formal economy. Without significant changes, Canada risks sustaining a global financial architecture that enables bad actors, particularly from developing nations, to siphon wealth and destabilize economies.

Time for Canada to Step Up

Canada has long prided itself on being a beacon of fairness and stability, but its approach to financial crimes falls short of this ideal. The lack of enforcement mechanisms for non-compliance in the financial and real estate sectors shows a troubling lack of urgency. While some efforts, such as mutual legal assistance agreements with source countries for illicit funds, have been discussed, they remain inadequate.

If Canada hopes to shed its reputation as a haven for laundered wealth, the government must act decisively. This includes rolling out a comprehensive national registry of beneficial landowners, enforcing AML standards in the real estate and mortgage sectors, and cracking down on the misuse of shell companies. Anything less risks turning the country into a permanent safe harbor for global financial malfeasance.

Canada must choose: Will it lead the fight against global money laundering, or will it continue to let its real estate markets become a refuge for illicit wealth? The world—and its citizens—are watching.

The opinions expressed in this article are those of the author. They do not purport to reflect the opinions or views of Khalsa Vox or its members.