AI Generated Summary

- An International Monetary Fund (IMF) mission is currently in Pakistan for discussions on the crucial second and final review of its short-term $3 billion rescue package.

- This cycle of dependence on IMF bailouts, coupled with a dearth of substantive reforms, has plunged Pakistan into a perpetual state of fiscal instability.

- This lifeline has been instrumental in bolstering Pakistan’s foreign exchange reserves and staving off a sovereign default, providing a semblance of stability in tumultuous economic waters.

Cash-strapped Pakistan has officially approached the International Monetary Fund (IMF) for another bailout package ranging between $6 billion and $8 billion, with the possibility of augmentation through climate financing.

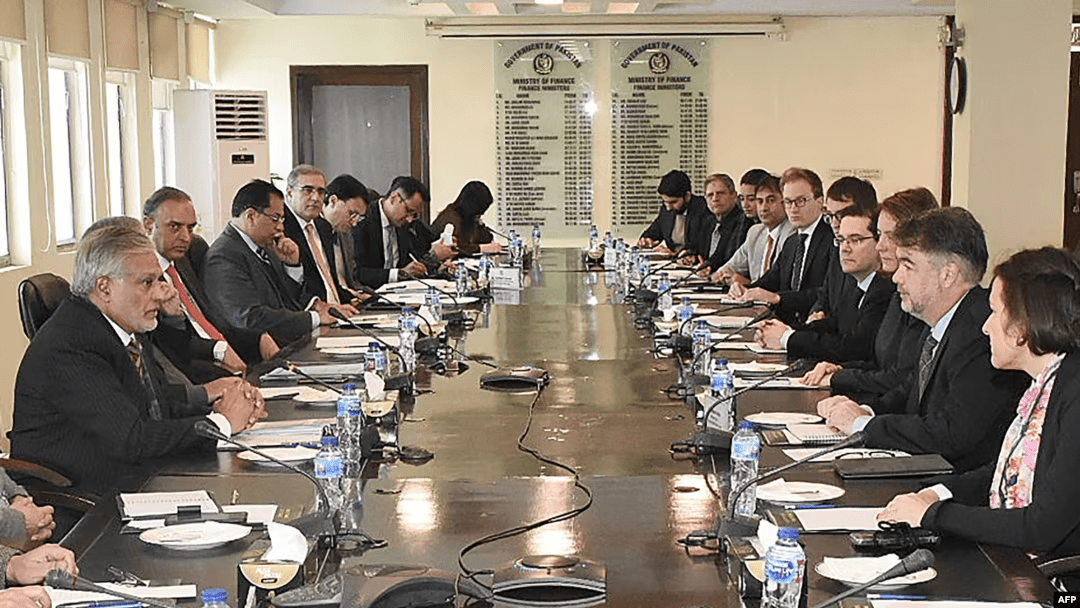

An International Monetary Fund (IMF) mission is currently in Pakistan for discussions on the crucial second and final review of its short-term $3 billion rescue package. This lifeline has been instrumental in bolstering Pakistan’s foreign exchange reserves and staving off a sovereign default, providing a semblance of stability in tumultuous economic waters.

The anticipated successful completion of this review is expected to pave the way for a staff-level agreement, unlocking a vital $1.2 billion tranche in the coming weeks. This injection of funds is paramount for Pakistan’s economy, serving as a lifeline amidst fiscal uncertainty.

Finance Minister Muhammad Aurangzeb has already hinted at broader discussions with the IMF for a larger and more prolonged successor bailout. While the specifics of this prospective funding remain undisclosed, the IMF has expressed its readiness to formulate a medium-term program should Islamabad opt for one.

Pakistan’s relationship with the IMF has become a recurring narrative, with this potentially marking its 24th engagement with the global lender. Regrettably, Pakistan stands as the most frequent and fourth-largest recipient of IMF assistance globally, a distinction highlighting deeper systemic issues.

The pressing question looms: Has Pakistan gleaned any insights from its prior 23 engagements with the IMF? A sobering reality emerges upon closer examination. With the exception of one, all previous programs were prematurely terminated due to stringent conditions, and none met their intended objectives.

This cycle of dependence on IMF bailouts, coupled with a dearth of substantive reforms, has plunged Pakistan into a perpetual state of fiscal instability. The populace bears the brunt of economic distress, grappling with the weight of unsustainable policies.

Critics argue that while IMF interventions provide short-term relief, they are inherently geared towards stabilization rather than sustainable growth. Consequently, Pakistan faces a bleak prognosis of economic pain and sluggish growth in the foreseeable future.

Zafar Masud, President and CEO of the Bank of Punjab, underscores the imperative of a substantial, homegrown economic revival plan. He emphasizes that IMF prescriptions, while necessary, offer temporary respite and fail to address entrenched structural deficiencies.

The new finance minister’s commitment to swift implementation of reforms signals a departure from protracted debates to decisive action. However, the crux of Pakistan’s economic malaise lies in its fragile fiscal position and burgeoning debt, exacerbated by a skewed distribution of wealth.

To chart a path towards economic resilience, Masud advocates for concerted efforts across political and economic spheres. This entails enhancing the tax base, fostering digital transformation, and orchestrating a synchronized approach to monetary and fiscal policies.

Pakistan stands at a crossroads where short-term relief must be balanced with long-term sustainability. While IMF assistance offers a lifeline, lasting solutions demand domestic ingenuity and unwavering commitment to reform. Only through cohesive action can Pakistan transcend the cycle of perpetual bailouts and forge a prosperous future for its citizens.

The opinions expressed in this article are those of the author. They do not purport to reflect the opinions or views of Khalsa Vox or its members.