AI Generated Summary

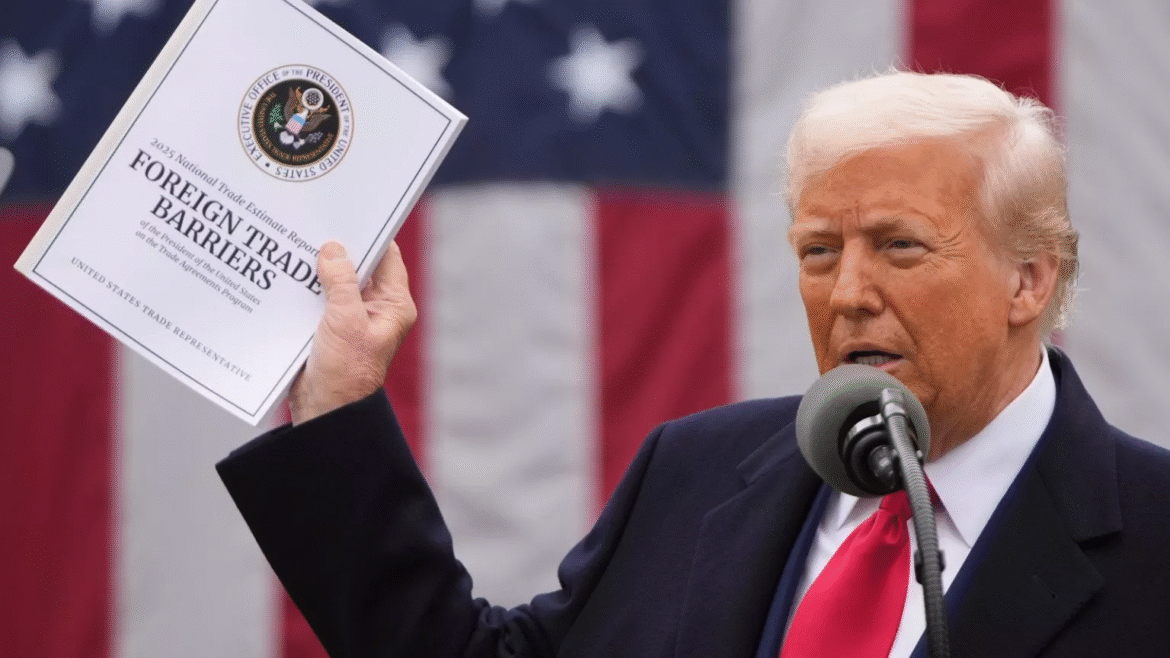

- In a surprise move, US President Donald Trump has announced a 25% additional import duty plus an unspecified penalty on goods imported from India.

- US think tanks argue that when accounting for services like education, tech, finance, and defense, the US might actually have a $35–40 billion surplus with India.

- A tariff is a tax imposed by one country on goods imported from another.

In a surprise move, US President Donald Trump has announced a 25% additional import duty plus an unspecified penalty on goods imported from India. The new tariffs, which will take effect from August 1, are being imposed as a punitive measure for India’s continued purchases of crude oil and military equipment from Russia, despite US sanctions.

Here’s a simplified breakdown of what this means, why it’s happening, and how it may affect businesses and consumers.

What is a tariff?

A tariff is a tax imposed by one country on goods imported from another. Importers usually pay this tax to the government, and in most cases, they pass this cost on to consumers, which can make imported goods more expensive.

What tariffs has the US announced on India?

The US has imposed:

- 25% additional tariff on Indian imports, plus a penalty (details pending).

- Other duties remain in place, such as:

- 10% general duty (announced earlier in April).

- 50% on steel and aluminium.

- 25% on autos and auto parts.

These new duties are in addition to existing tariffs. For instance:

- Textiles currently face up to 69% tariffs. With the new hike, they could be subject to up to 94% duty.

- Penalty charges (yet to be defined) could increase this burden further.

Why is the US imposing these tariffs?

The US claims:

- India maintains high tariffs on American goods, restricting US exports.

- The bilateral trade imbalance is too wide, with the US importing far more from India than it exports.

- India continues to do strategic trade with Russia, which Washington views as a violation of its sanctions.

What does US–India trade look like?

- In 2024–25, bilateral trade hit $186 billion.

- India exported $86.5 billion to the US.

- India imported $45.3 billion from the US.

- India enjoys a trade surplus of over $41 billion with the US.

- In services, India had a $3.2 billion surplus.

However, US think tanks argue that when accounting for services like education, tech, finance, and defense, the US might actually have a $35–40 billion surplus with India.

What are the major goods traded?

India’s top exports to the US:

- Medicines and pharmaceuticals

- Telecom equipment

- Precious stones and jewellery

- Petroleum products

- Garments and auto parts

India’s top imports from the US:

- Crude oil

- Petroleum products

- Coal and minerals

- Aircraft parts

- Gold and diamonds

How will these tariffs impact trade?

- Indian products will become more expensive in the US, potentially reducing demand.

- Labour-intensive industries—garments, footwear, handicrafts, jewellery, carpets—may be hit hardest.

- Competitor nations like Vietnam, Bangladesh, and Thailand already face tariffs around 20–36%, so India’s new rates make it less competitive.

What are the expected duties on key Indian goods from August 1?

| Product | New Duty Rate |

|---|---|

| Telecom equipment | 25% |

| Gems and jewellery | 30–38.5% (up from 5–13.5%) |

| Food and agri products | 29–30% (up from 14–15%) |

| Apparel | 12% + 25% = 37% total |

| (Penalty may apply additionally) |

Are Trump’s allegations about high Indian tariffs justified?

- India does have higher tariffs than the US:

- Average Indian tariff: 17%

- Average US tariff: 3.3%

- However, India’s rates are comparable to countries like China (7.5%) and South Korea (13.4%).

- The US itself imposes high duties on several items:

- Dairy: 188%

- Cereals and food preparations: 193%

- Fruits and vegetables: 132%

So while India does have relatively high tariffs, the US is not immune to protectionism either.

What’s next?

- Businesses may seek exemptions or push for negotiations.

- The penalty component remains undefined, so uncertainty remains.

- This move could strain US–India trade relations, especially as a trade agreement was under negotiation.

- Exporters will likely shift focus to other markets, or cut prices, affecting profit margins.

Bottom line:

These tariffs represent a significant shift in US trade policy toward India. While they are aimed at curbing India’s defense ties with Russia, the economic fallout may be broad, affecting key Indian industries and possibly escalating into a deeper trade conflict unless resolved diplomatically.